Feature Story

More feature stories by year:

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007

2006

2005

2004

2003

2002

2001

2000

1999

1998

Return to: 2016 Feature Stories

Return to: 2016 Feature Stories

CLIENT: IDTECHEX

Apr. 11, 2016: EE Times

Dr Khasha Ghaffarzadeh, IDTechEx

Three sectors dominate with billion dollar-sized business -- OLED displays, sensors, and conductive inks.

From many different angles, the printed electronics sector is gaining commercial momentum. Large electronic manufacturing services (EMS) companies, such as Jabil and Flex, are investing in technology development with partners in addition to scaling up manufacturing. There have been many investments from VCs to strategic venturing, involving investors such as ARM and Samsung Investment Corporation. Most importantly, more products have come to market, from complete devices, such as the temperature sensing band-aid and infant respiration vest, to companies using printed electronics for part of the device, from the inkjet printed polymer layers used in barrier films on some OLED displays to over one billion printed RFID tag antennas.

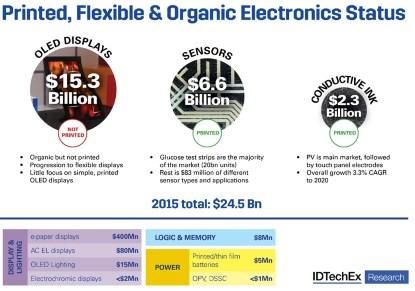

The state of the industry in terms of market size by component type is summarized in the following chart, based on research conducted by IDTechEx for over 15 years on the sector. Three sectors dominate with billion dollar-sized business, which are OLED displays (organic, but not printed), sensors (mainly printed glucose test strips), and conductive inks (predominately used for photovoltaic bus bars and electrodes for touch screens, but there are many other applications).

(Source: IDTechEx report: Printed, Organic & Flexible Electronics Forecasts, Players & Opportunities 2016-2026, www.IDTechEx.com/pe)

Now let's consider ten brief industry updates across different parts of the sector as follows...

The key selling point for Quantum Dots (QDs) is that they enable a much wider color gamut with minimal re-engineering of the LCD panels. The marketing spiel is OLED-like performance from LCD-like prices. There are a diverse range of products on the market today, but there are three main hurdles holding them back from the big time.

First is cost -- the current estimate is that a QD film will add around $100 for every square meter of display. Second is the fact that there is no guarantee that consumers will notice the improvement. Supporters of quantum dots say that it is currently the only way to obtain TV displays that are compliant with the Rec. 2020 standard. However, while the specifications are impressive, it is worth noting that most consumers do not even know that their LCD devices (TV, laptop, or tablet) have a limited color gamut (of course, marketing can win consumers around). Third is toxicity -- the best quantum dots are made with cadmium, a substance that is usually banned in the European Union under the RoHS regulations. The display industry obtained an exception to introduce cadmium in TVs because of the benefits in terms of lower energy consumption (thereby reducing carbon emissions) but this is reviewed from time to time.

In 2016, IDTechEx Research estimates that 23.6 million QD devices will be sold with a market value of $657 million, rising to $11.3 billion in 2026.

Hundreds of tons of carbon nanotubes (CNTs) are being used each year in batteries in premium devices such as smartphones and electric vehicles, whereby they enable faster charging of the batteries. For example, one brand of smart phone can charge from empty to 70% in an hour versus from empty to 55% in an hour without the addition of CNTs. CNTs have moved past the period of hype. Graphene is at an earlier commercialization stage, but a number of graphene suppliers are prioritising energy storage, including for supercapacitors, silicon anode batteries, and lithium sulphur batteries. Indeed, of the total market for graphene in 2026, energy storage applications will be 40% of the market share for graphene – larger than any other graphene application.

A typical mobile phone has between three and five antennas. These antennas can be made using a variety of techniques, such as stamp foiling, flexible FPC, laser direct structuring (LDS), or aerosol deposition. The antennas are typically structurally integrated to save space, meaning that they form part of a device component and are not on a separate PCB.

In addition to cost and space utilization, lead-time and turn-around time are becoming increasingly important industry drivers. This is because the consumer electronics value chain operates on very tight and frequent release schedules. A key challenge for stamp and flexible FPC techniques is that a change in design will necessitate a change in tooling.

Now, aerosol deposition is an emerging competitor. After being primarily an R&D tool for many years, aerosol deposition machines are currently being installed in higher numbers, having already established a commercial production capacity of >15 million antennas per year. This technique does not require special thermoplastic and is already competing with LDS on cost. This is a market on the rise, with many silver nanoparticle ink suppliers lining up to qualify their inks with the leading aerosol machines on the market.

Printed electronics and wearable technology are converging across sports and fitness, healthcare, and personal electronics. Just two years ago, only a few players -- such as Nagase and DuPont -- had launched stretchable conductive ink, but now many more have entered the market. Key applications for smart clothing are sport-specific apparel, real-time monitoring of babies and the elderly for caregivers' peace-of-mind, and monitoring of first responders. Substrate TPU is screen-printed with conductive, dielectric, and "sensor" inks, and then laminated onto fabric. As an example, DuPont is working with 150 different companies on applications for their stretchable inks. This is in addition to those developing conductive yarns and conductive polymer textiles.

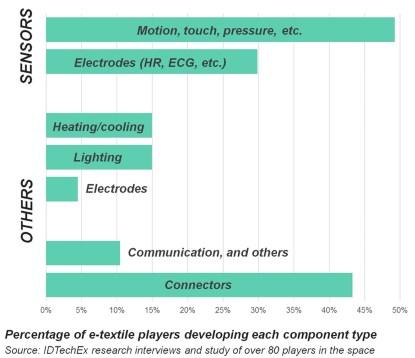

A key opportunity around wearables is how to connect the electronic textiles to the typical box of electronics containing the processing and power. Snap fasteners are most commonly used today but -- even as we move away from boxes of electronics to textile integrated devices -- the challenge of securing components to the textile remains. When interviewing over 80 organizations involved in e-textiles, IDTechEx found that -- after developing sensors -- connectors are the second highest priority of the players involved, as pictured below.

(Source: E-Textiles 2016-2016 from IDTechEx Research)

Whoever says that flexible displays are a tiny market is wrong. They miss out on the 100 million electrophoretic displays that have been sold; these are plastic-based and flexible, although the final form may be rigid. Volume shipments peaked in 2011 in the form of e-readers, but have been falling ever since as consumers increasingly choose color LCD tablets. Sales of reflective display e-readers have now stabilized at about 10 million units a year. Rising from this are many new applications for reflective displays, with the greatest growth coming from electronic shelf edge labels. These will use some 40 million reflective displays this year, up from 30 million in 2015. Additionally, Apple has taken over some of the Qualcomm Mirasol assets, and Amazon remains hard at work with the electro-wetting technology it acquired from Samsung. Several new entrants are also coming to market with new reflective display technologies.

LG Display announced last year an investment of approximately $900 million in order to build an OLED display facility. The total investment in the plant, which is designed to produce both large-size OLED TV and flexible OLED panels for smartwatches and automotive displays, is expected to reach more than $8.7 billion. By 2020, the market for plastic-based OLEDs will reach $16 Billion.

From 2013 to 2016, the champion efficiency of unstabilized Perovskite PV has gone from under 16% to over 22%, as benchmarked by NREL in the US. Unfortunately, despite strong enthusiasm last year, there are few companies developing Perovskite PV devices and the topic now barely registers in most mainstream press. However, this does not mean that much is not happening behind the scenes. Champion cell efficiencies make good headlines, but that doesn't mean they are product-ready. Most effort has been concentrated on materials development -- improving stability while maximizing efficiency and, in some cases, creating lead free versions. This will take time, with IDTechEx Research anticipating that the first products will be hybrid silicon-perovskite PV systems creating a market of over $200 million in 2025.

Last year, IDTechEx Research correctly predicted that the transparent conductive film (TCF) industry had entered a period of intense consolidation. The TCF industry generated more than $400 million in 2015, but consolidation was triggered because ITO film makers adopted the policy of protecting their market share at the expense of profit margin to stave off the threat of substitutes. This meant that they slashed their prices piecemeal every time they sensed they were poised to lose business. The net effect was that selling prices were reduced from around $30/sqm to less than $20/sqm in less than 1.5 years. This was compounded with disappointing demand for medium- to large-sized touch displays and All-in-One PCs. As a result, it became a buyers' market.

The cycle of over-valuation followed by a correction induced via a consolidation period is common in many emerging industries. This is a natural part of the commercialization process and an aspect that IDTechEx Research has seen elsewhere when studying emerging technologies. Such times offer a prime opportunity for companies to pick leading technologies at discount prices. IDTechEx Research expects that this will be witnessed in the next one to two years in the TCF industry.

In-mold electronics (IME) is an emerging and hot area in printed electronics. With this approach, functional and electronic layers are first printed on a 2D flat sheet. The sheets are then thermoformed or injection-molded into a 3D shape. In general, the approach tends to be best-suited to applications where high volumes of low-complexity circuits are required; therefore, mechanical switches used in the automotive and appliances sectors are the primary initial targets. The key benefits are that thin and elegant devices with structurally-integrated electronics can be developed.

This technique, the suppliers claim, can reduce weight by 70% by removing wires and buttons and by enabling the PCB size to be reduced. It can also reduce time by around 30% since the process is simple and includes few manufacturing steps. It's expected that IME devices will become nearly a $1 billion market by 2026.

For more info on the printed electronics ecosystem, check out the IDTechEx Printed Electronics Europe event in Berlin on April 27-28.

Return to: 2016 Feature Stories